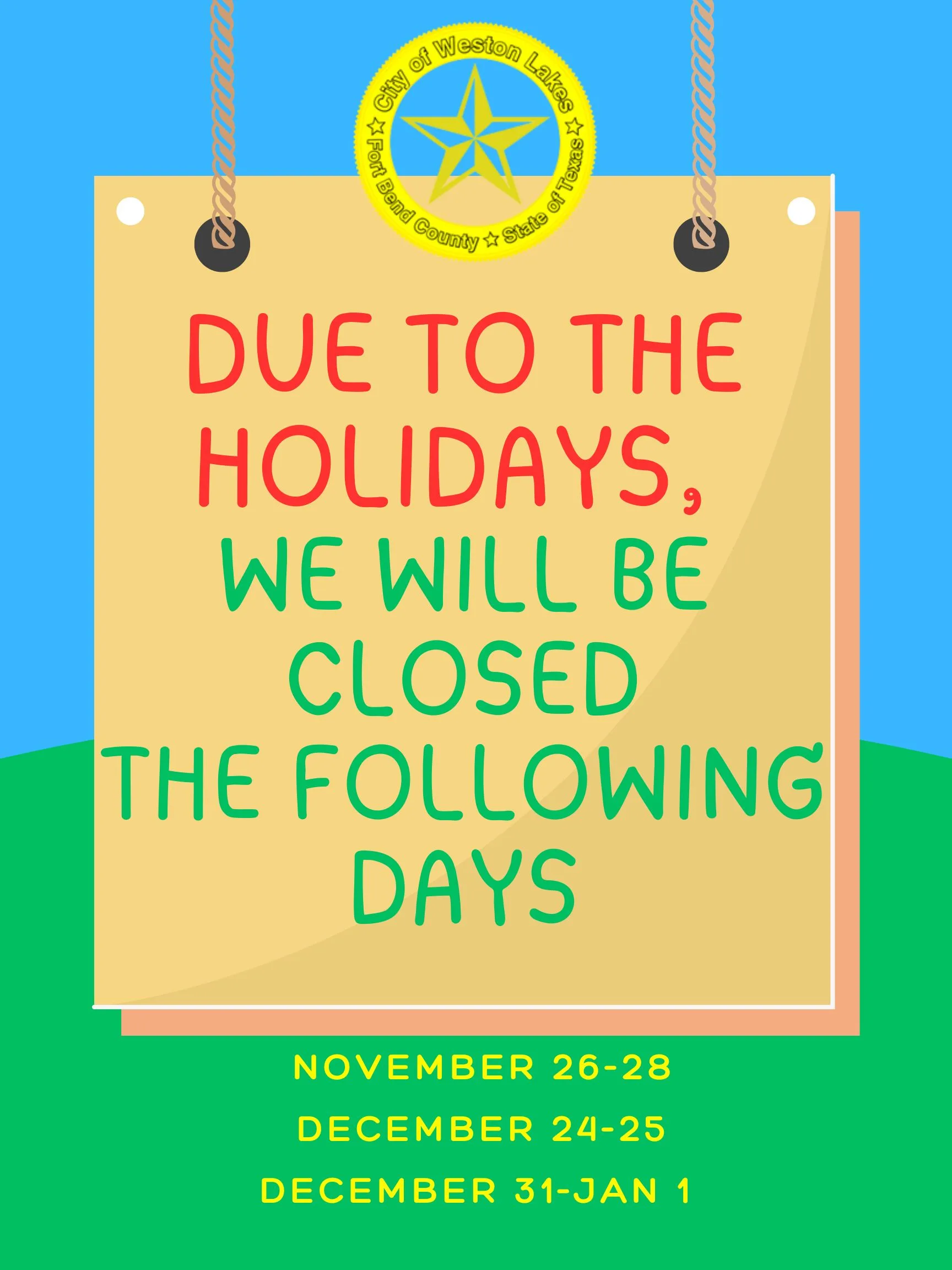

2026 Holidays for City of Weston Lakes

As the end of the year is near, we are letting all of our residents know the holidays the city observes. We are only open on Mondays and Wednesdays, so only some of these holidays will affect operations.

As the end of the year is near, we are letting all of our residents know the holidays the city observes. We are only open on Mondays and Wednesdays, so only some of these holidays will affect operations.

We will be closed for Thanksgiving November 26th. We will reopen Monday, December 1st!

In December we will be closed Wednesday, December 24th, reopening Monday, December 29th.

We will also be closed Wednesday, December 31… We will reopen Monday, January 5th!

Weston Lakes is proud to have had the highest voter turn out in our precinct in elections past, so let’s keep up the good work!

Today early voting began, a list of dates, times and locations can be found HERE.

There are constitutional amendments, bond issues, and sales and use tax elections. For the sample ballot, click HERE.

If you caught the parade, you probably saw him riding on the Fort Bend Mayor’s float, waving to everyone and kicking off the fun.

Mayor Wall then switched gears from parade VIP to entertainment host:

It’s awesome to see Mayor Bob Wall jumping right into all the action and celebrating the best of Fort Bend County!

Effective October 1, 2025 the sales and use tax that our residents voted in favor of will begin to capture 2% of all sales tax in our City Limits.

If you have a business attached to your Weston Lakes address, we ask that you make sure any sales tax generated is going to Weston Lakes instead of Fulshear.

You can call 800-531-5441 or email the Texas Comptroller at taxallocation@cpa.texas.gov

There will be a meeting of the board of directors for the Fort Bend Subsidence District on Tuesday, September 23, 2025 at 10am at the William B Travis Building at 301 Jackson St Richmond, Texas.

See below notice:

There was a public meeting held on August 28, 2025 at the Fort Bend Epicenter. TxDOT is looking for public feedback.

Please note there are four ways to provide input:

Please click HERE for the website.

The City Council for the City of Weston Lakes will hold it’s regular city council meeting along with the public hearing for the proposed budget for the FY 2025-2026 on Tuesday, August 26th at 6pm in the Weston Lakes Country Club Ballroom.

Notice is hereby given that the City Council of the City of Weston Lakes, Texas will hold a public hearing on the City’s Proposed 2025-2026 Fiscal Year Budget, on August 26, 2025 at 6:00 p.m., at the Weston Lakes Country Club, 32611 FM 1093, Weston Lakes, Texas. All persons desiring to be heard regarding said proposed budget will be afforded an opportunity to do so. The proposed budget is available for public inspection on the city website or by contacting the City Secretary via phone (281) 533-0907 or email citysec@westonlakestexs.gov between the hours of 11:00 a.m. and 5:00 p.m. Monday and Wednesday.

The City of Weston Lakes will hold its regular city council meeting on Tuesday, July 22nd at 6pm in the ballroom at the Weston Lakes Country Club. Agenda can be found HERE.